Introduction - Planning for Bereavement

Many of us prefer not to think about death. However, there are important decisions and plans you can make in advance which may make things considerably more straight forward for you and your family towards the end of your life. This can be especially helpful for your family and friends if they know in advance where you would prefer to be cared for towards the end of your life and whether you have preferences as to what happens at your funeral or where you wish to be buried.

It is always a good idea to talk about these issues with those who are closest to you and to make a written record of your preferences. It will reassure your family that you have thought about the issues carefully and give them confidence that they are acting in accordance with your wishes when making important decisions.

Keep copies of important documents and make sure that your immediate family know where the documents are kept.

Making a Will

Your Will lets you decide what happens to your money, property and other possessions after your death. If you make a Will, you can also make sure you do not pay more Inheritance Tax than necessary. You can write your Will yourself, but it is advised that you get qualified legal advice, especially if your Will is not straightforward.

You need to get your Will formally witnessed and signed to make it legally valid. If you want to update your Will, you need to make an official alteration (called a ‘codicil’) or make a new will.

Your Will should set out:

- who you want to benefit from your Will

- who should look after any children under 18

- who is going to sort out your estate and carry out your wishes after your death (your executor)

- what should happen if the people you want to benefit pass away before or at the same time as you.

You should particularly get advice from a professional if your Will is not straightforward, for example:

- you share a property with someone who is not your husband or wife

- you want to leave money or property to a dependant who cannot care for themselves or is under 18 years

- you have several family members who may make a claim on your Will, such as a second spouse or children from another marriage

- your permanent home is outside the UK

- you have property overseas

- you have a business.

Further information is available here: https://www.gov.uk/make-will

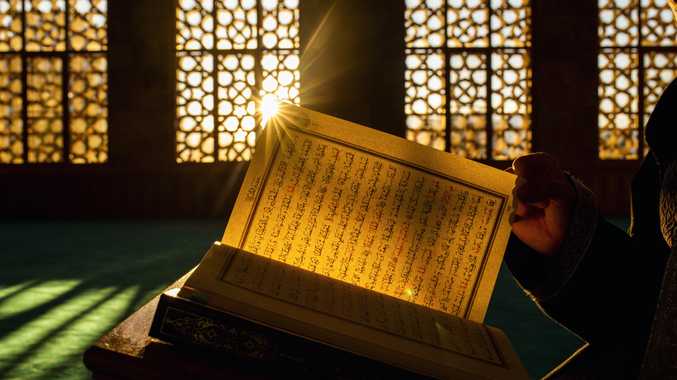

Inheritance and Will-Writing in the Qur’an and Sunnah

An Islamic Shariah Will, also known as a ‘wasiyyah’, is a legal document in which a person making the Will (also known as a testator) makes a disposition of their assets to be executed upon death. In order to make an Islamic Will, however, you need to know what you are permitted to gift, bequest and what is the mandatory inheritance prescribed within Sharia law (‘faraid’).

This is a fardh (obligatory) action to implement. All schools of thought are agreed that wealth does not belong to us as individuals and we are obliged to follow the rulings on the distribution of inheritance. It is an important act of worship to submit to this understanding.

‘To Allah belongs all that is in the heaven and all that is in the earth’ (Surah Baqarah, verse 284)

“It is not permissible for any Muslim who has something to will, to stay for two nights without having his last will and testament written and kept ready with him.” (Sahih Al-Bukhari, Volume 4: Book 55, Chapter 1).

“There is a share for men and a share for women from what is left by parents and those nearest related, whether the property be small or large – a legal share.” (Verse No. 7, Surah An-Nisa’).

From an Islamic perspective, three things benefit the deceased:

- Pious children

- Beneficial knowledge

- Sadqah jariyah (ongoing charity) – this can be included in your “Will” and can also be given during your lifetime.

Tax Planning

Inheritance Tax is a tax on the estate (the property, money and possessions) of someone who has died.

There is normally no Inheritance Tax to pay if either:

- the value of your estate is below the inheritance tax threshold

- you leave everything above the inheritance tax threshold to your spouse, civil partner, a charity or a community amateur sports club

You may still need to report the estate’s value to HMRC even if it is below the threshold.

If you give away your residential home to your children (including adopted, foster or stepchildren) or grandchildren, your threshold can increase.

If you are married or in a civil partnership and your estate is worth less than your threshold, any unused threshold can be added to your partner’s threshold when you die.

Tax Planning is a notoriously complex area and you are recommended to obtain independent legal and tax advice from a recognised professional. Please see the Useful Contacts section for further information.

Gifts

Some gifts you give while you are alive may be taxed after your death. Depending on when you gave the gift, ‘taper relief’ might mean the Inheritance Tax charged on the gift is less than the full inheritance tax rate.

Tax rates, thresholds, eligibility criteria are subject to change and you should always check the current situation with a competent professional advisor or HMRC. Further information is available here: https://www.gov.uk/inheritance-tax

Power of Attorney

If you are aged 18 or older and have the mental capacity to make financial, property and medical decisions for yourself, you can arrange for someone else to make these decisions for you in the future. This legal authority is called “lasting power of attorney”. The person who is given power of attorney is known as the “attorney” and must be over 18 years old. You are known as the “donor”.

There are 3 different types of power of attorney: lasting power of attorney (LPA), enduring power of attorney (EPA) and ordinary power of attorney. An ordinary power of attorney allows someone to look after your financial affairs for a temporary period. It will end if you lose the mental capacity to make decisions.

You may think your partner or close family members can make decisions for you if you are not able to do so yourself, but this is not the case. If they had to pay your bills or make a choice about your care, they would need legal authority to do so. A lasting power of attorney lets people you trust quickly, easily, and legally step in when you need it most. If you lose the ability to make certain decisions, a lasting power of attorney keeps those decisions with the people you trust, to support you when you need it most. It could be temporary help with your decisions during a short hospital stay, or support to manage decisions around your health and care in the longer-term.

It’s generally recommended that you set up both a Health and Welfare LPA and a Property and Financial Affairs LPA at the same time. Many people do this while reviewing or revising their will, and you may be able to use the same solicitor.

You should always take professional legal advice before putting in place a power of attorney. More information is available here:

You must register your LPA or your attorney will not be able to make decisions for you. You can do this here: https://www.gov.uk/power-of-attorney/make-lasting-power

Paying for a funeral

The funeral can be paid for:

- from a financial scheme the person had, for example a pre-paid funeral plan or a bereavement committee (sometimes known in the community as a death committee)

- by you, or other family members or friends

- with money from the person’s estate (savings, for example) – getting access to this is called applying for a ‘grant of representation’ (sometimes called ‘applying for probate’)

You could get a Funeral Expenses Payment from the Department for Work & Pensions (also called a Funeral Payment) if you get certain benefits and need help to pay for a funeral you are arranging. The payment will not usually cover all of the costs of the funeral and may take some time to be paid.

How much you get depends on your circumstances. This includes any other money that is available to cover the costs, for example from the deceased person’s estate. Further information is available here: https://www.gov.uk/funeral-payments